Life is full of uncertainties. We never know what lies ahead of us. Accidents can happen in the blink of an eye, and illness can strike unexpectedly.

It doesn’t matter if we are young or old, healthy or not, these unfortunate events can affect anyone at any time. That’s why having insurance is crucial. Insurance provides a safety net, giving us financial protection and peace of mind when we need it the most.

The importance of insurance in protecting our finances

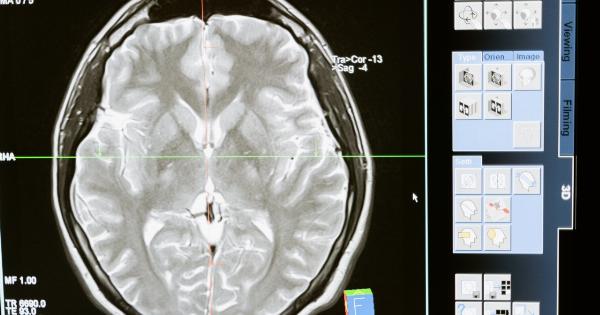

One of the primary reasons why insurance is essential is because it protects our finances. Accidents and illnesses can lead to significant medical expenses and, in some cases, long-term treatment costs.

Without insurance, these expenses can quickly drain our savings and put us in a financially vulnerable situation.

Medical insurance, for instance, covers the cost of hospitalization, surgeries, medication, and other medical treatments. It ensures that we receive the necessary care without worrying about the financial burden.

Similarly, health insurance can also cover preventive care, which helps in detecting health issues early on, potentially saving both lives and money.

Moreover, insurance policies like disability insurance and critical illness insurance provide financial support when we are unable to work due to accidents or serious illnesses.

These policies offer temporary or permanent disability benefits, helping us cover our everyday expenses and maintain our quality of life.

Insurance as protection against unexpected circumstances

Life is unpredictable. We can never be fully prepared for unexpected events. However, having insurance provides a layer of protection against these unforeseen circumstances. It helps us mitigate the financial risks associated with accidents and illnesses.

Take car insurance as an example. Despite being cautious drivers, accidents can still occur due to factors beyond our control. Car insurance protects us from the financial repercussions of these accidents.

It covers damages to our vehicle, medical expenses, and even liability in case we cause harm to others. Without insurance, we would have to bear these costs ourselves, which can be financially crippling.

Similarly, home insurance is crucial in safeguarding our most significant asset. Natural disasters, fires, and burglaries can cause substantial damage to our homes and belongings.

Home insurance provides us with the financial means to repair or rebuild our homes and replace our belongings in the event of such disasters.

Additionally, insurance plays a vital role in protecting our loved ones in the event of our untimely death. Life insurance ensures that our dependents are financially secure and can continue their lives without major disruptions.

It can cover funeral expenses, outstanding debts, and provide a source of income for our loved ones.

Peace of mind and emotional well-being

Insurance not only provides financial protection but also offers peace of mind and emotional well-being. Knowing that we have insurance coverage can alleviate the stress and anxiety that come with unexpected events.

When accidents or illnesses strike, we can focus on recovery and healing rather than worrying about the financial consequences.

Insurance gives us the freedom to make decisions based on what is best for our well-being without constantly worrying about the cost.

Moreover, insurance can also provide support through additional services. Many insurance policies offer access to healthcare networks, counseling services, and other resources that can contribute to our overall well-being.

These services can prove invaluable during challenging times, allowing us to navigate through difficult situations with the necessary support and guidance.

Factors to consider when choosing insurance

With numerous insurance options available, choosing the right insurance policies can be overwhelming.

It is important to consider several factors to ensure that the insurance coverage meets our specific needs and provides the necessary level of protection.

1. Coverage: Evaluate the coverage offered by different insurance policies. Ensure that the policy covers the specific risks you want to protect against.

For example, if you live in an area prone to earthquakes, make sure your home insurance includes earthquake coverage.

2. Premiums: Consider the affordability of the insurance premiums. Review the monthly or annual costs and determine if it fits within your budget.

However, bear in mind that while lower premiums may seem attractive, they might offer limited coverage.

3. Deductibles and co-pays: Understand the deductibles and co-pays associated with the insurance policies.

Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in, while co-pays are the fixed amounts you are responsible for each time you receive medical services. Find the right balance between premiums, deductibles, and co-pays that works for your financial situation.

4. Provider network: If you are considering health insurance, review the provider network associated with the policy. Ensure that your preferred healthcare providers are included in the network to have access to quality care.

5. Policy limits and exclusions: Understand the limits of coverage and any exclusions mentioned in the policy. Some policies have maximum limits on benefits or exclusions for pre-existing conditions.

Be aware of these limitations to avoid surprises when making claims.

6. Insurance company reputation: Research the reputation and financial stability of the insurance company. Look for customer reviews and ratings to gauge the company’s reliability and claims process efficiency.

7. Additional benefits: Consider any additional benefits or riders that may be available with the insurance policy. These may include coverage for alternative treatments, maternity benefits, or access to wellness programs.

Choosing a policy with added benefits can enhance the value of your insurance coverage.

The importance of reviewing insurance coverage regularly

Once you have chosen the appropriate insurance policies, it is essential to review them regularly. Life changes, and our insurance needs may evolve over time. Regular reviews allow us to ensure that our coverage aligns with our current circumstances.

Factors that may trigger a review include:.

1. Life events: Significant life events such as marriage, divorce, the birth of a child, or the death of a loved one can impact our insurance needs. Review your policies and make any necessary adjustments to ensure adequate coverage.

2. Changes in health: If you experience changes in your health, it is important to assess your health insurance coverage. You may require additional coverage or different policy options to meet your evolving healthcare needs.

3. Asset accumulation: As you accumulate assets, such as purchasing a new home or acquiring valuable belongings, review your home insurance and personal property coverage. Make sure these assets are adequately protected.

4. Career advancements: Career advancements often come with increased income and lifestyle changes.

As your financial situation improves, consider adjusting your life insurance coverage to reflect your new income level and provide sufficient financial support for your loved ones.

5. Retirement planning: As you approach retirement, review your insurance policies to ensure they align with your retirement plans.

You may no longer need certain types of coverage or may need to enhance coverage in other areas, such as long-term care insurance.

Conclusion

No one is immune to accidents and illnesses. They can happen to anyone, at any time. That’s why insurance is key. Insurance provides the necessary financial protection and peace of mind when we need it the most.

It safeguards our finances, protects us against unexpected circumstances, and provides peace of mind and emotional well-being. When choosing insurance, it is crucial to consider factors such as coverage, premiums, deductibles, provider networks, policy limits, and the reputation of the insurance company.

Regularly reviewing our insurance coverage ensures that it remains aligned with our changing needs and circumstances. Remember, insurance is not just a financial investment; it is an investment in our well-being and the security of our loved ones.