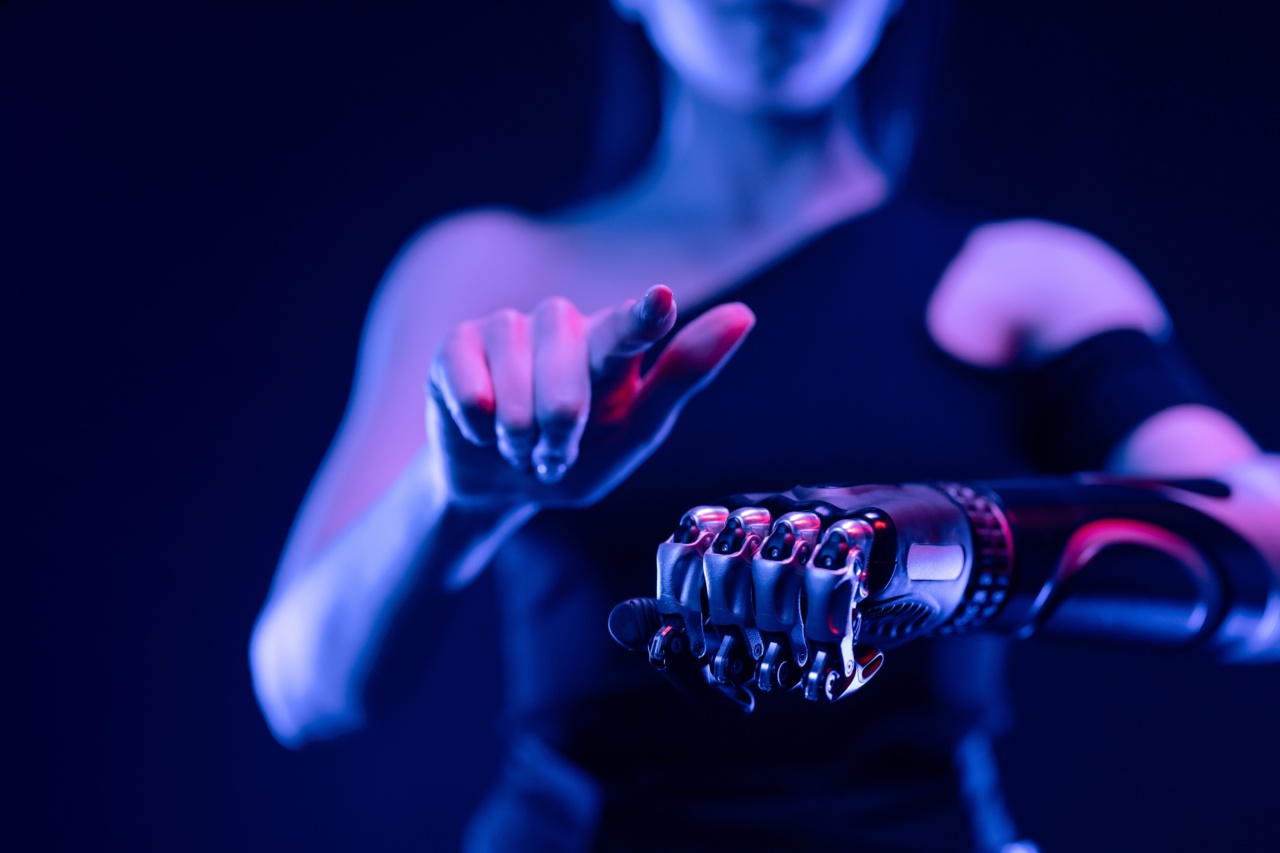

Artificial limbs are prosthetic devices used by amputees to replace lost limbs. They are a boon for people who have lost their limbs due to accidents, injuries, or illnesses.

The cost of artificial limbs can be high, and for this reason, people often go for insurance policies that can cover the cost of prosthetic devices.

If you’re someone who’s lost a limb or you are looking to invest in artificial limbs, you need to ensure you choose the right insurance policy that can provide adequate coverage.

: Types of Artificial Limbs Insurance Policies

There are two types of artificial limbs insurance policies:.

Individual Health Insurance Policies

Individual health insurance policies cover the patient’s medical expenses, including the cost of artificial limbs. These policies vary depending on the insurance company, and you can select the policy based on your individual needs and budget.

Most insurance companies provide plans that cover the cost of artificial limbs after the patient pays the deductible. The cost for an individual health insurance policy depends on the patient’s age, health condition, and coverage level.

Group Insurance Policies

Group insurance policies are offered by employers or organizations to their employees. These policies offer coverage for medical expenses, including the cost of artificial limbs.

The insurance premium for group policies is paid by the employer, and the employees have the option to choose the policy based on their individual needs. Group insurance policies often cover the cost of artificial limbs without any additional charges.

: Type of Artificial Limbs Covered

Artificial limbs insurance policies cover different types of prosthetic devices depending on the policy. Some policies cover the cost of one type of prosthetic device while others cover all types available on the market.

The common types of artificial limbs covered by insurance policies include:.

Upper Limb Prosthetics

Upper limb prosthetics are designed for amputees who have lost their hand, elbow or arm. They include hand prosthetics, prosthetic elbows, and prosthetic arms.

Lower Limb Prosthetics

Lower limb prosthetics are designed for amputees who have lost their foot, ankle, knee, or leg. They include prosthetic feet, prosthetic ankles, prosthetic knees, and prosthetic legs.

Cosmetic Prosthetics

Cosmetic prosthetics are designed to look like the missing limb but do not offer any functional benefit to the amputee.

Microprocessor Prosthetics

Microprocessor prosthetics are technologically advanced artificial limbs that are designed to mimic natural movement and function of a missing limb.

These prosthetics use sensors and microprocessors to adjust to the user’s movement and provide an improved range of motion.

: Factors to Consider When Choosing Artificial Limbs Insurance Policy

When choosing an artificial limb insurance policy, you need to consider several factors. They include:.

Deductibles and Premiums

You need to consider how much you are willing to pay out-of-pocket before the insurance coverage kicks in. Generally, the higher the deductible, the lower the premiums you’ll pay.

If you anticipate needing prosthetic devices regularly, consider choosing a lower deductible plan to keep costs affordable over time.

Policy Coverage Limits

Check to see if the policy has any annual or lifetime limits on coverage. Be sure these limits are adequate for your needs, and if not, explore other policy options that do better.

Reputation of Insurance Company

Before purchasing a policy, check out the company’s reputation for paying out claims, handling disputes, and other customer service issues.

If your policy is going to be paying for expensive prosthetic devices over time, you want to be sure the insurance provider is trustworthy and dependable.

Medical Provider Network

Check to see if the insurance policy has a preferred network of medical providers.

Choosing qualified providers within that network can save you money, but you’ll want to be sure they have the expertise and track record in the type of prosthetics you require.

: Conclusion

If you are a candidate for an artificial limb, obtaining proper insurance coverage is essential to ensure that the high costs of these devices and the related medical care do not cripple your finances.

By taking the time to understand the types of policies available and the various factors that you need to consider when choosing one, you can choose the best policy to meet your needs while keeping costs manageable over time.