Having a solid health coverage policy is crucial for individuals and families to protect themselves from unexpected medical expenses and ensure access to quality healthcare.

In today’s unpredictable world, it is essential to have an insurance plan that provides comprehensive coverage and empowers individuals to take control of their healthcare needs. This article will delve into the importance of having a solid health coverage policy and how it can empower individuals to prioritize their health without the burden of financial stress.

Protection against Unexpected Medical Expenses

One of the primary reasons to have a solid health coverage policy is to protect against unexpected medical expenses.

Healthcare costs can be exorbitant, and without insurance, individuals may be forced to face substantial bills that can quickly drain their savings or push them into debt. A comprehensive health coverage policy ensures that individuals are financially protected in case of illness, injury, or any other medical emergencies.

Access to Quality Healthcare

Another significant advantage of having a solid health coverage policy is the access it provides to quality healthcare. With insurance, individuals can choose from a network of healthcare providers who maintain high standards of medical care.

This allows individuals to receive prompt and effective treatment from qualified professionals, ensuring their health needs are met in the best way possible.

Preventive Care and Wellness Programs

Many health coverage policies also emphasize preventive care and wellness programs.

These policies usually cover regular check-ups, screenings, vaccinations, and other preventive healthcare measures that can detect potential health issues early and help individuals maintain a healthy lifestyle. By prioritizing preventive care, individuals can prevent the development of chronic illnesses and stay on track with their overall well-being.

Financial Security and Peace of Mind

A solid health coverage policy provides individuals with much-needed financial security and peace of mind.

In the event of a medical emergency or unforeseen illness, insurance coverage ensures that individuals can seek necessary medical attention without worrying about the cost. This peace of mind allows individuals to focus on their recovery and well-being, instead of stressing over the financial implications of medical treatment.

Empowering Individuals to Make Informed Choices

Having a solid health coverage policy empowers individuals to make informed choices about their healthcare.

With access to a range of medical providers and treatments covered by insurance, individuals can actively participate in their healthcare decisions. They can seek second opinions, explore different treatment options, and have the freedom to choose the healthcare professionals they trust.

This empowerment allows individuals to take control of their health and ensure they receive the best possible care.

Support during Times of Crisis

A health coverage policy serves as a support system during times of crisis. Serious illnesses or accidents can be emotionally and financially devastating, but having insurance coverage can ease the burden in such situations.

Insurance provides the necessary support to access specialized medical care, cover hospitalization expenses, and support ongoing treatments, ensuring individuals receive the care they need without adding additional stress to their lives.

Encouraging Early Detection and Treatment

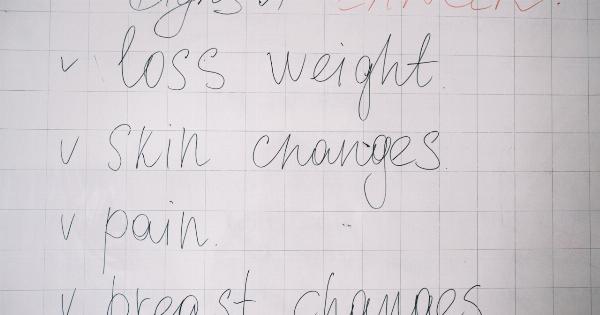

Many health coverage policies include coverage for various medical screenings and tests that encourage individuals to seek early detection of potential health issues.

Timely diagnosis and early intervention can significantly improve treatment outcomes and overall prognosis. With insurance coverage, individuals are more likely to prioritize regular screenings and tests, leading to early detection and prompt treatment.

Protecting Future Financial Goals

Healthcare costs can have a significant impact on an individual’s or a family’s financial goals. Without insurance, medical expenses can eat into savings that were intended for education, homeownership, or retirement.

By having a solid health coverage policy, individuals can protect their financial goals and ensure that unexpected medical expenses do not derail their long-term plans.

Choosing the Right Health Coverage Policy

When it comes to choosing the right health coverage policy, it’s essential to consider one’s unique healthcare needs and financial situation.

Factors such as the extent of coverage, network of healthcare providers, out-of-pocket costs, and premium affordability should all be carefully evaluated. Individuals should research and compare different policies available to them, seeking guidance from insurance professionals if needed, to make an informed decision that best suits their individual needs.

The Bottom Line

Having a solid health coverage policy is crucial for individuals and families to empower themselves with financial security, access to quality healthcare, and the ability to prioritize their overall well-being.

By investing in a comprehensive health coverage policy, individuals can take control of their healthcare needs, protect against unforeseen medical expenses, and ensure peace of mind for themselves and their loved ones.