In today’s rapidly changing world, insurance has become an essential component of our lives. With uncertainties and risks lurking around every corner, having adequate insurance coverage is crucial for protecting ourselves and our valuables.

Whether it’s our health, home, car, or business, insurance provides a safety net that helps us navigate through unexpected events and minimize their impact. This article explores the significance of insurance in a rapidly changing world and highlights its various benefits.

Risk Management

One of the primary purposes of insurance is risk management. As the world continues to evolve, new risks emerge while existing ones evolve in complexity.

Insurance acts as a shield against these risks by providing financial protection and compensating for potential losses. It offers a sense of security and peace of mind, allowing individuals and businesses to focus on their activities without constant worry about potential setbacks.

Financial Protection

Insurance offers financial protection against unforeseen circumstances. Whether it’s a sudden illness, a natural disaster, an accident, or theft, insurance policies provide compensation to cover the associated costs.

Without insurance, individuals and businesses would bear the entire financial burden of such events, which can often be overwhelming and even bankrupting.

Healthcare Coverage

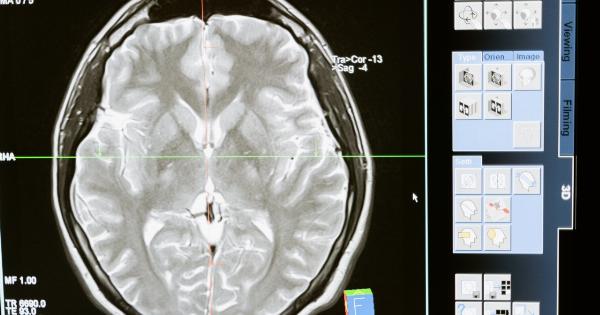

In a rapidly changing world, healthcare expenses are on the rise, making health insurance indispensable. With the increasing prevalence of chronic diseases, access to quality healthcare is crucial.

Health insurance offers coverage for medical expenses, including doctor visits, hospital stays, medications, and surgeries. It ensures that individuals can receive the necessary healthcare without incurring exorbitant costs and ensures timely access to treatments and preventive care, improving overall health outcomes.

Protecting Personal Assets

Insurance helps protect personal assets such as homes, cars, and personal belongings. In a changing world where natural disasters, accidents, and thefts are prevalent, having insurance coverage provides financial protection in case of damage or loss.

Home insurance covers the cost of repairs or rebuilding in the event of fire, flood, or other catastrophes. Auto insurance compensates for damages resulting from accidents, thefts, or vandalism. Without insurance, individuals would bear these costs alone, potentially leading to severe financial hardships.

Business Continuity

For businesses, insurance plays a vital role in continuity planning. With rapidly evolving technologies, globalization, and new market trends, businesses face various risks that can disrupt their operations.

Insurance policies such as property insurance protect against damage to buildings or equipment, while liability insurance covers legal costs resulting from lawsuits and claims. Business interruption insurance helps cover lost income and expenses during a disruption, ensuring that businesses can recover and continue operating.

Enhancing Economic Stability

Insurance contributes to economic stability by distributing risks among a large pool of insured individuals and businesses. By pooling premiums and compensating for losses, insurance companies stabilize the financial impact of unexpected events.

This stability encourages economic growth and provides a safeguard against potential bankruptcies and financial crises. Additionally, insurance companies invest premiums received, further stimulating economic activities.

Promoting Innovation and Entrepreneurship

Insurance plays a significant role in promoting innovation and entrepreneurship in a rapidly changing world.

By mitigating risks, insurance allows entrepreneurs to pursue new ventures, invest in research and development, and explore uncharted territories without fear of catastrophic financial losses. It encourages creativity, experimentation, and investments in emerging technologies, supporting economic growth and progress.

Adaptability to Changing Needs

The insurance industry, driven by the changing needs of individuals and businesses, continuously evolves to provide relevant coverage. As new risks emerge, insurance companies develop innovative policies to address these challenges.

This adaptability ensures that insurance remains effective in meeting the evolving needs of individuals, businesses, and society as a whole.

Peace of Mind

Above all, insurance provides peace of mind in a rapidly changing world. It relieves individuals and businesses from constant fear and uncertainty by offering protection and support during challenging times.

The knowledge that there is a safety net in place allows people to focus on their daily activities, pursue their dreams, and plan for the future without being overwhelmed by the fear of potential losses.

Conclusion

In a rapidly changing world, the importance of insurance cannot be overstated. Insurance provides risk management, financial protection, and peace of mind. It protects personal assets, promotes economic stability, and supports entrepreneurship.

By adapting to changing needs, insurance continues to serve as a vital tool for navigating uncertainties and mitigating risks. As the world evolves, insurance remains an essential component of our lives, ensuring that we can face the future with confidence.