Robotic surgery has revolutionized the medical industry, offering a less invasive and more precise surgical option for many procedures.

However, with this innovation comes the need for proper insurance reimbursement to cover the cost of these robotic surgeries. Understanding the insurance reimbursement process for robotic surgery can be complex, but with the right guidance, it can be a manageable and beneficial process for both patients and providers.

What is Robotic Surgery?

Robotic surgery is a minimally invasive surgical technique that uses small incisions for complex procedures. The surgeon operates a robotic system that uses small instruments and a high-definition camera to perform the surgery.

The robotic system translates the surgeon’s hand movements into precise movements of the instruments, allowing for a more precise surgery with less trauma and scarring for the patient.

Why is Robotic Surgery More Expensive?

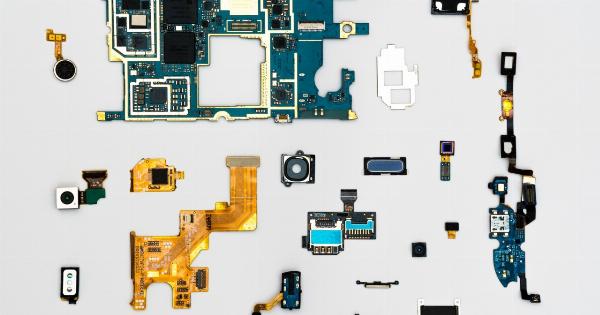

Robotic surgery requires additional training and specialized equipment, which can make it more expensive than traditional surgical techniques. Additionally, the cost of the robotic system and maintenance can also add to the cost.

However, the benefits of robotic surgery, such as shorter recovery times and fewer complications, can ultimately lead to cost savings in the long run.

How Insurance Reimbursement Works

Insurance reimbursement is the process by which insurance companies pay for medical services rendered by healthcare providers.

The reimbursement process for robotic surgery is similar to that of traditional surgeries, but there are some differences that should be noted.

Pre-Approval Process

Before a robotic surgery can be performed, the healthcare provider must first obtain pre-approval from the insurance company.

The pre-approval process helps to ensure that the robotic surgery is medically necessary and that the patient’s insurance coverage will cover the cost of the procedure.

Covered Benefits

Not all insurance plans cover robotic surgery, and some plans may only cover specific types of procedures. Patients should review their insurance plan to determine if robotic surgery is covered and what benefits are available to them.

Providers should also check with the insurance company to verify coverage and determine any limitations or exclusions.

Coding and Billing

Proper coding and billing are vital to ensure that insurance reimbursement is successful. Healthcare providers must use specific codes to indicate the type of procedure performed and the equipment used during the surgery.

The codes must be accurate and reported in a timely manner to avoid delays or denials in payment.

Appeals Process

If a claim is denied or paid at a lower rate than expected, there is an appeals process that allows providers to challenge the decision.

The appeals process can be lengthy and complex, requiring detailed documentation and justification for the robotic surgery. Providers should work closely with the patient and insurance company during the appeals process to provide all necessary information and support.

Benefits of Robotic Surgery Insurance Reimbursement

Although the insurance reimbursement process for robotic surgery can be complex, the benefits of proper insurance reimbursement are significant for both patients and providers.

For Patients

Robotic surgery can offer many benefits to patients, such as less pain, scarring, and a shorter recovery time. However, these benefits can come at a higher cost than traditional surgical techniques.

Proper insurance reimbursement can help to reduce the financial burden on patients and make robotic surgery more accessible to those who need it.

For Providers

Robotic surgery can be a significant investment for healthcare providers, but it can also lead to increased revenue and patient satisfaction.

Proper insurance reimbursement can help to ensure that providers are reimbursed for their investment and can continue to offer this valuable service to their patients.

Conclusion

Robotic surgery offers many benefits to patients and healthcare providers, but it requires proper insurance reimbursement to ensure accessibility and financial viability.

Understanding the insurance reimbursement process is essential for both patients and providers to ensure that robotic surgery is accessible to those who need it and that providers are appropriately compensated for their investment.