Living with chronic or congenital diseases can be a challenging experience, both for the patient and their families. These conditions require significant financial investments in healthcare as well as emotional and physical energy.

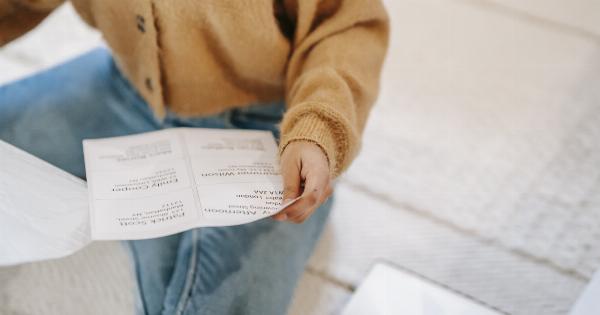

Health contract coverage ensures that an individual’s medical expenses are covered by the insurance provider. It is, therefore, essential to understand the terms and conditions surrounding the policy to ensure there are no surprises when it’s time to file a claim.

What Are Chronic and Congenital Diseases?

A chronic disease is a medical condition that lasts more than a year and requires ongoing medical attention. These conditions are often progressive, resulting in a worsening of the patient’s health over time.

Examples of chronic diseases include cancer, diabetes, heart disease, and HIV/AIDS.

Congenital diseases, on the other hand, are medical conditions that exist from birth. They are usually caused by inherited genetic abnormalities or complications that occur during pregnancy or childbirth.

Some examples of congenital diseases include Down syndrome, cystic fibrosis, and sickle cell anemia.

Importance of Health Contract Coverage for Chronic and Congenital Diseases

Chronic and congenital diseases require ongoing medical attention, making the cost of treatment very high. Health contract coverage alleviates these expenses by covering the medical costs incurred by the patient.

This coverage ensures that the patient does not have to worry about medical bills and can focus on their health and well-being. Moreover, some chronic and congenital diseases might require medication and medical equipment, further adding to the costs that can be covered by health contract coverage.

Without adequate coverage, individuals living with these conditions might have difficulty getting the medical attention they need, which may result in debilitating health complications.

Exclusions to Health Contract Coverage

Health contract coverage does not cover all medical expenses. There are exclusions to the policy that the patient should be aware of to avoid surprises when filing for claims or getting treatments.

Here are some of the common exclusions from health contract coverage policies:.

Pre-Existing Conditions

If a patient has been diagnosed with a chronic or congenital disease before getting health contract coverage, the expenses incurred in treating that condition may not be covered.

Most insurance providers set a waiting period for pre-existing conditions before coverage can kick in.

Experimental Treatments

Experimental treatments for chronic and congenital diseases may not be covered. If a new drug for a chronic condition is being tested, the insurance provider typically does not cover the costs incurred in administering the treatment.

Alternative Medicine

Alternative medicine such as acupuncture, massage therapy, and naturopathy is generally not covered by health contract coverage policies.

Patient Non-Compliance

Patients are required to follow the treatment plan prescribed by their doctors diligently. Failure to adhere to the plan may result in the insurance provider denying coverage for expenses incurred in the course of treatment.

Out-of-Network Providers

Insurance companies usually have a network of medical providers with whom they have negotiated rates. Out-of-network providers often result in higher expenses, and those costs may not be covered by health contract coverage policies.

Negotiating Health Contract Coverage

When shopping for health contract coverage, it is essential to review the terms and conditions of the policy.

If an individual has been diagnosed with a chronic or congenital disease, they need to make sure that the policy covers the costs associated with treating the condition. Here are some tips for negotiating health contract coverage:.

Shop Around

It’s essential to compare different insurance providers’ policies and rates to get the best deal. Most insurance providers offer different policies to cater to individuals’ different needs.

Ask About Waiting Periods and Exclusions

Patients should ask insurance providers about the waiting period for pre-existing conditions, exclusions, and any other clauses that might have an impact on coverage.

Maintenance Medication

Patients living with chronic and congenital diseases often have to take medication for extended periods. It’s essential to ensure that maintenance medication is covered in the policy.

Review the Policy

It’s essential to review the policy thoroughly before signing up. Patients should make sure that the coverage aligns with their medical needs and budget.

Conclusion

Health contract coverage is essential for individuals living with chronic and congenital diseases.

However, insurance providers have different policies and exclusions that patients should be aware of to avoid surprises when filing a claim or getting treatment. Patients need to compare different policies before signing up and ensure that the policy covers their medical needs. By understanding health contract coverage, patients can get the medical care they need without worrying about the financial burden.