Health insurance is a crucial factor in ensuring individuals and their families receive the medical care they need without experiencing significant financial burdens.

One of the key aspects of health insurance is the premium, which individuals pay periodically to access their healthcare benefits. In 2020, health insurance premiums experienced several changes due to various factors, including evolving healthcare costs, legislative modifications, and demographic shifts.

This article aims to provide an in-depth look at health insurance premiums in 2020, their determinants, and the implications they hold for individuals and the healthcare industry.

The Basics of Health Insurance Premiums

Health insurance premiums are the periodic payments individuals make in exchange for medical coverage.

These payments are typically made monthly, quarterly, or annually and play a crucial role in determining the extent of coverage an individual or their family receives. The premium amount differs based on various factors, including the type of plan, coverage levels, individual demographics, and the region in which they reside.

Factors Influencing Health Insurance Premiums

Health insurance premiums are determined through a meticulous evaluation of multiple factors that impact healthcare costs and individual risk profiles. Some of the key factors that influence health insurance premiums include:.

1. Age

Age is an important determinant of health insurance premiums. Generally, younger individuals tend to have lower premiums compared to older adults.

This is because younger individuals usually require less medical attention and are less prone to chronic diseases or health conditions prevalent in older populations.

2. Health Conditions

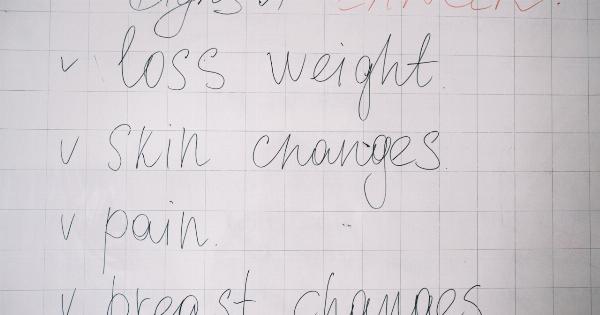

An individual’s health status is a significant factor in determining health insurance premiums. Those with pre-existing health conditions may face higher premiums as they are more likely to require frequent and expensive medical treatments.

3. Tobacco Use

Tobacco use is often linked to a multitude of health conditions, ranging from lung cancer to heart diseases.

Individuals who smoke or use other tobacco products generally face higher health insurance premiums due to the increased risk of these conditions.

4. Geographical Location

The region in which an individual resides can impact health insurance premiums. Healthcare costs can vary significantly across different areas, with some regions having higher average healthcare expenses.

Therefore, individuals living in these regions may face higher premiums.

5. Plan Type and Coverage Levels

The type of health insurance plan an individual selects and the level of coverage they choose also affect the premiums.

Plans with lower deductibles and broader coverage tend to have higher premiums compared to those with higher deductibles or limited coverage options.

6. Family Size

The number of individuals covered under a health insurance plan affects the premium amount. Plans covering larger families may have higher premiums compared to those only covering individuals or small families.

Changes in Health Insurance Premiums in 2020

The year 2020 brought about several changes in health insurance premiums due to a variety of factors. Some of the significant changes observed in premiums during this year include:.

1. Increasing Healthcare Costs

The overall costs of healthcare continued to rise in 2020, and these increases were reflected in health insurance premiums.

This was primarily driven by rising drug prices, medical technology advancements, and the expenses associated with providing high-quality care.

2. Impact of the Affordable Care Act (ACA)

The Affordable Care Act, also known as Obamacare, had a substantial impact on health insurance premiums in 2020.

While the ACA aimed to increase access to affordable healthcare, it also led to increased premiums for some individuals due to more extensive coverage mandates and the elimination of certain insurance plans.

3. COVID-19 Pandemic

The unprecedented global COVID-19 pandemic significantly impacted health insurance premiums in 2020. As healthcare systems faced increased strain, insurance companies had to adapt to the changing landscape.

While the full extent of these pandemic-related changes is yet to be determined, many insurance providers have taken steps to provide coverage for COVID-19 testing and treatment.

4. Legislative Changes

Changes in legislation can also impact health insurance premiums. In 2020, there were various legislative modifications that affected premiums, such as policy changes related to Medicaid, Medicare, and private health insurance markets.

Implications for Individuals and the Healthcare Industry

The changes in health insurance premiums in 2020 hold multiple implications for individuals and the healthcare industry as a whole. Some of these implications include:.

1. Affordability of Coverage

Higher premiums can make it challenging for individuals to afford health insurance coverage, especially for those who do not receive employer-sponsored plans or government subsidies.

This may result in individuals being uninsured or underinsured, leading to potential financial strain in the case of unexpected medical expenses.

2. Access to Care

Changes in health insurance premiums can impact an individual’s access to necessary medical care.

Higher premiums may discourage individuals from seeking healthcare services, leading to delayed or inadequate treatment, potentially resulting in poorer health outcomes.

3. Shift towards Preventive Care

Rising healthcare costs and the need to control them have led to an increased focus on preventive care.

Health insurance companies may offer incentives for individuals who engage in preventive measures to reduce the risk of developing costly chronic conditions. This shift towards preventive care can help lower healthcare expenses in the long run.

4. Insurance Market Competitiveness

The changes in health insurance premiums in 2020 can impact the competitiveness of insurance providers. Those companies offering more affordable premiums while maintaining quality coverage may attract a larger customer base.

Conclusion

Health insurance premiums in 2020 were influenced by various factors, including age, health conditions, tobacco use, geographical location, plan type, and family size.

The COVID-19 pandemic and legislative changes also had a significant impact on premiums throughout the year.

Understanding the determinants and implications of health insurance premiums is crucial for individuals seeking quality healthcare coverage and the healthcare industry as a whole, as it enables them to make informed decisions regarding their health choices and expenses.