As we age, it becomes even more crucial to ensure that we have adequate insurance coverage in place. While insurance may not be the most exciting topic, it is a practical and necessary aspect of safeguarding your future.

Here are five compelling reasons to prioritize insurance as you age:.

1. Financial Protection for Your Loved Ones

One of the primary reasons to secure insurance as you age is to provide financial protection for your loved ones.

Whether you have dependents, a spouse, or aging parents who rely on you, having proper insurance coverage can alleviate the financial burden that may arise in the event of your disability or death.

Life insurance, for example, offers a lump sum payment to your beneficiaries in the unfortunate event of your passing.

This money can help cover funeral expenses, outstanding debts, mortgage payments, and provide financial stability for those left behind.

2. Supplementing Retirement Income

As you approach retirement age, insurance can play a crucial role in supplementing your retirement income. Annuity insurance, specifically, can provide a regular stream of income during your retirement years.

An annuity allows you to contribute funds over time and then receive a consistent payout once you retire.

This additional income can make a significant difference in maintaining your standard of living and ensuring a comfortable retirement.

By starting an annuity plan early, you can take advantage of compounding interest and build a substantial nest egg for your retirement.

3. Coverage for Expensive Medical Treatments

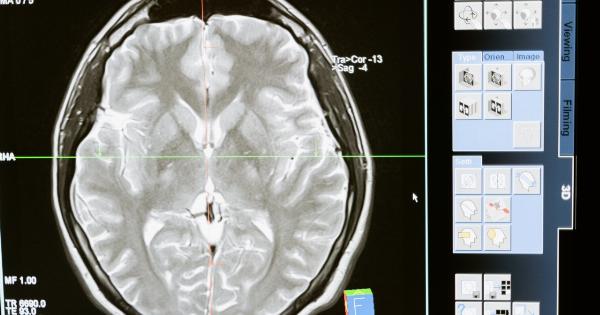

As we age, the likelihood of developing health issues increases. It’s essential to have health insurance that adequately covers the cost of expensive medical treatments and medications.

Even if you are covered by Medicare, it may not cover all expenses, leaving you exposed to significant out-of-pocket costs.

By investing in supplemental health insurance, you can ensure that you have the necessary coverage to manage any medical emergencies or chronic conditions that may arise as you age.

This type of insurance can provide coverage for prescriptions, hospital stays, surgery, and other medical expenses that may otherwise deplete your savings.

4. Long-Term Care Insurance

Long-term care insurance is specifically designed to cover the cost of extended care services, such as assistance with bathing, dressing, eating, and other activities of daily living.

Many people require long-term care as they age, whether it’s due to a chronic health condition or general age-related decline.

Long-term care insurance can help alleviate the financial burden associated with these services, which can cost thousands of dollars per month.

Having this type of coverage ensures that you can access the care you need while protecting your savings and assets from being depleted.

5. Peace of Mind

Lastly, having insurance as you age provides peace of mind. Knowing that you and your loved ones are protected financially in the face of unforeseen circumstances can alleviate stress and worry.

Instead of dwelling on what could go wrong, you can focus on enjoying life and creating lasting memories with your family and friends.

With insurance coverage in place, you can feel secure knowing that you have taken proactive steps to safeguard your future.

Whether it’s life insurance, health insurance, or long-term care insurance, the peace of mind that insurance offers is invaluable.

Conclusion

Insurance becomes increasingly important as we age due to the financial responsibilities and risks that come with growing older.

From providing financial protection to loved ones to ensuring supplemental retirement income and coverage for expensive medical treatments, insurance plays a vital role in securing our future well-being.

Investing in insurance as you age not only protects your assets and savings but also offers peace of mind and security.

With the right insurance coverage in place, you can confidently navigate the challenges and uncertainties that come with aging, allowing you to focus on enjoying a fulfilling and worry-free life.