Testicular health is an integral part of overall well-being for men. The testicles, also known as the testes, play a crucial role in the production of testosterone and sperm.

Any issues related to testicular health can have a significant impact on a man’s fertility, sexual function, and overall quality of life. While insurance is typically associated with medical care for chronic conditions or emergencies, it is equally important to be aware of its coverage for testicular health.

Common Testicular Health Conditions

There are various testicular health conditions that can affect men. Some of the most common ones include:.

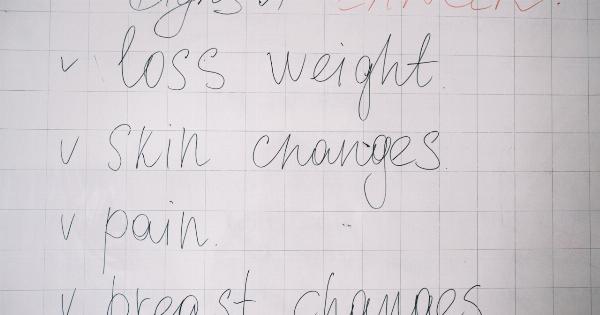

1. Testicular Cancer

Testicular cancer is a malignancy that develops in the testicles. It usually affects young men between the ages of 15 and 35. Early detection and treatment are crucial for a successful outcome.

Insurance coverage plays an essential role in ensuring timely diagnosis and access to appropriate treatments such as surgery, radiation therapy, and chemotherapy.

2. Testicular Torsion

Testicular torsion occurs when the spermatic cord, which provides blood flow to the testicle, twists, cutting off the blood supply. It is a painful and potentially serious condition that requires immediate medical attention.

Insurance coverage can help alleviate the financial burden associated with emergency services, surgery, and follow-up care.

3. Testicular Trauma

Testicular trauma can result from an injury or accident, such as a direct blow to the scrotum. It can lead to pain, swelling, and potential long-term complications.

Insurance coverage can help cover diagnostic tests, consultations with specialists, and any necessary surgical interventions.

4. Testicular Infections

Infections of the testicles, such as epididymitis or orchitis, can cause discomfort, inflammation, and potential fertility issues.

Insurance coverage can help with the costs of medications, diagnostic tests, and consultations with urologists or infectious disease specialists.

5. Testicular Atrophy

Testicular atrophy refers to the shrinking of the testicles, often due to hormonal imbalances or underlying medical conditions. It can impact testosterone production and fertility.

Insurance coverage can assist with the costs of hormone replacement therapy, consultations, and monitoring.

Importance of Insurance Coverage

Having appropriate insurance coverage is crucial for effectively managing testicular health conditions.

Insurance provides financial protection and access to necessary medical services, allowing men to receive timely care and reduce the potential impact on their well-being.

1. Regular Check-ups and Preventive Care

Insurance coverage enables men to undergo regular check-ups and preventive care measures, such as testicular self-exams and visits to urologists.

Early detection of any abnormalities can significantly increase the chances of successful treatment and recovery.

2. Diagnostic Tests and Imaging

Diagnostic tests and imaging play a vital role in identifying and diagnosing various testicular health conditions.

Insurance coverage ensures that men have access to ultrasound scans, blood tests, and other necessary diagnostic procedures without financial barriers.

3. Specialist Consultations

Testicular health conditions often require consultations with specialists, such as urologists or oncologists.

Insurance coverage allows men to seek the expertise of these professionals, ensuring they receive accurate diagnoses, treatment plans, and ongoing care.

4. Medications and Treatments

From surgical interventions to chemotherapy or hormone therapy, the treatments for testicular health conditions can be extensive and costly.

Insurance coverage helps offset these expenses, ensuring individuals can pursue the necessary treatments without experiencing significant financial strain.

5. Fertility Preservation

Some testicular health conditions, such as testicular cancer or certain treatments, may pose risks to future fertility.

Insurance coverage may cover the costs associated with fertility preservation methods, such as sperm banking or reproductive assistance treatments.

Considerations for Insurance Coverage

When evaluating insurance coverage for testicular health, there are several key factors to consider:.

1. Network Coverage

Ensure that the insurance plan includes healthcare providers and specialists who specialize in urology and testicular health. In-network providers often offer reduced costs and more streamlined reimbursement processes.

2. Coverage Limitations

Review the insurance policy to understand any coverage limitations, such as pre-existing condition waiting periods, maximum coverage amounts, or restrictions on certain treatments or medications.

Familiarize yourself with these limitations to make informed decisions.

3. Premiums and Deductibles

Consider the overall cost of the insurance coverage, including monthly premiums and deductibles. Compare different plans to find a balance between affordability and comprehensive coverage for testicular health.

4. Policy Exclusions

Some insurance policies may have exclusions related to specific testicular health conditions or treatments.

Understand these exclusions, especially if you have a pre-existing condition, to clarify what expenses are covered and what may require additional financial arrangements.

Conclusion

Testicular health is a critical aspect of men’s overall well-being, impacting fertility, sexual function, and hormone production.

Insurance coverage plays an essential role in ensuring timely access to diagnostics, treatments, and consultations with specialists. Understanding the extent of coverage, policy limitations, and available benefits is crucial for effectively managing testicular health conditions.

By making informed decisions about insurance coverage, men can protect their testicular health while minimizing any financial impact.